Energy trading might sound complex, but it’s a vital part of how we manage and distribute energy. Imagine it as the marketplace where energy is bought and sold, much like fruits and vegetables at your local market. But instead of apples and oranges, we’re talking about oil, gas, and electricity.

With experience in this field, I’ve seen firsthand how energy trading shapes the world we live in. It’s not just about numbers and graphs; it’s about making sure homes stay warm, businesses keep running, and industries have the power they need. At its core, energy trading is all about balancing supply and demand, ensuring that energy is available where it’s needed, when it’s needed.

Whether you’re curious about how energy prices are set or how traders make decisions, this guide will break down the essentials in a way that’s easy to grasp. So, let’s dive into the world of energy trading and uncover how this crucial system works to keep our daily lives powered up.

Also Read: Common Terminologies Used In Stock Market?

Energy trading is the buying and selling of energy resources like oil, natural gas, and electricity. Think of it like buying and selling products, but instead of gadgets or groceries, it’s energy. Energy trading is crucial because it helps balance supply and demand. For instance, if one region has a surplus of oil and another has a shortage, trading helps move oil to where it’s needed. It also helps companies manage risks related to price changes, ensuring they can plan and budget effectively.

Also Read: How to Avoid FOMO During Crypto Trading

Energy trading is all about buying and selling energy, like oil, gas, and electricity. Here’s a simple way to understand how it works:

Energy traders connect people or companies that have energy with those who need it. For example, a power plant that produces electricity might sell it to a utility company that provides power to homes and businesses.

Energy can be traded in different ways. It can be traded physically, meaning the actual energy is delivered. Or it can be traded financially, where traders buy and sell contracts that are based on future energy prices without ever moving the physical energy.

In physical trading, deals are made for the actual delivery of energy. If a company needs oil now, they buy it and arrange for transportation. In financial trading, traders buy contracts predicting future prices of energy. If they think prices will rise, they buy contracts now and sell them later at a higher price.

Energy trades can happen on exchanges like the New York Mercantile Exchange (NYMEX) or over-the-counter (OTC) markets. Exchanges are like a big marketplace where prices are transparent and regulated, while OTC markets are more flexible and less regulated.

Traders use various strategies to protect themselves from price changes. For example, if a company is worried that oil prices will rise, they might buy a futures contract to lock in today’s price, avoiding unexpected costs in the future.

Also Read: Key Psychological Traits of Successful Traders

Energy trading is vital for the global market for several key reasons:

Energy trading helps match where energy is produced with where it’s needed. For example, if one country has a lot of oil but doesn’t need all of it, trading allows that oil to be sold to another country that does need it. This keeps energy supplies steady and avoids shortages.

By allowing energy to be bought and sold in different markets, trading helps keep prices from fluctuating wildly. When traders buy and sell energy based on current and future needs, it helps smooth out price spikes and crashes.

Energy prices can change a lot due to factors like weather, political events, or supply issues. Trading helps companies and governments manage these energy trading risk management. For example, a company might use trading to lock in energy prices and protect itself from future price increases.

A well-functioning energy market attracts investment. Investors are more likely to put money into energy projects if they know there’s a reliable way to buy and sell energy and manage risks.

Reliable and stable energy supplies are crucial for economic development. By facilitating smooth energy trading, markets help support industries and economies worldwide, leading to growth and development.

Energy trading has come a long way, evolving significantly over the years:

In the past, energy trading was simple and local. People traded energy resources like wood and coal directly, often on a small scale. This was mostly done through direct exchanges between producers and consumers.

As industries grew, so did the need for more organized energy trading. The discovery of oil and gas led to larger-scale production and transportation, making trading more complex. Pipelines and railroads began playing a crucial role in moving energy from where it was produced to where it was needed.

The 20th century saw significant changes with the development of financial markets and trading technologies. The introduction of futures contracts allowed traders to buy and sell energy at agreed prices for the future. This helped manage risks and stabilize prices.

With the rise of computers and the internet, energy trading became faster and more efficient. Electronic trading platforms emerged, allowing traders to buy and sell energy more quickly and transparently.

Today, energy trading is a global, highly sophisticated market. It involves various types of trades, from physical deliveries to complex financial instruments. Technology continues to advance, with innovations like AI and blockchain playing an increasing role in shaping the future of energy trading.

Also Read: Moving Averages for Day Trading

Energy trading can be divided into several types, each with its own approach and purpose:

This involves the actual buying and selling of energy commodities, like oil, gas, or electricity, with the delivery of these goods taking place. For example, an energy company might buy crude oil and arrange for its transportation to a refinery.

Instead of trading the actual energy, this type involves trading contracts based on the future prices of energy. Traders buy and sell these contracts to profit from price changes without dealing with the physical energy. For instance, someone might buy a futures contract for natural gas, betting that its price will rise by the time the contract expires.

This is about buying or selling energy for immediate delivery. The transaction is settled quickly, reflecting the current market price. If a power plant needs electricity right now, they would use spot trading to acquire it.

This involves buying or selling energy for delivery at a future date at a price agreed upon today. It helps traders lock in prices and manage risks related to price fluctuations. For example, a company might purchase a futures contract for oil to secure a price several months ahead.

OTC trading happens directly between parties without going through an exchange. This allows for customized contracts but can be less transparent. For instance, two companies might agree on a private contract for oil delivery.

These are formal markets where energy contracts are traded on regulated exchanges. They offer standardized contracts and are more transparent. For example, crude oil futures are commonly traded on exchanges like the NYMEX.

Also Read: Mastering Risk Management in Forex Trading

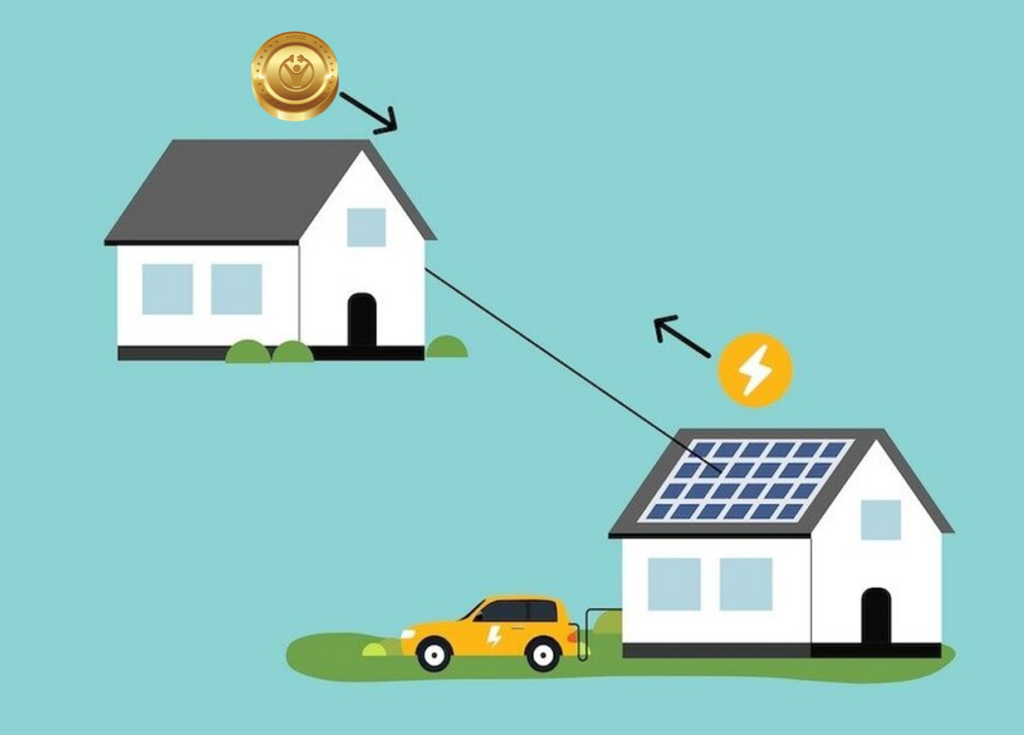

Peer-to-peer (P2P) energy trading is a system where individuals or businesses buy and sell energy directly with each other, without needing a middleman like a traditional utility company. This process is made possible by using technology, especially blockchain, to securely and transparently manage transactions. Here’s how it works:

Homeowners or businesses with renewable energy sources, like solar panels, can produce their own electricity.

They use a digital platform to offer their excess energy for sale to others in their community who need it.

Buyers and sellers agree on prices and terms directly through the platform. This setup can lead to better prices and more efficient energy use.

Blockchain technology and smart contracts automate and secure the transactions. Smart contracts are digital agreements that automatically execute when conditions are met, ensuring transparency and reducing the risk of fraud.

Also Read: Can Forex Trading Be Chosen as a Job?

Energy commodities are basic goods that are traded in the energy market. They are crucial because they fuel homes, businesses, and industries. Here’s a quick look at the main types:

This is unrefined petroleum and is one of the most traded energy commodities. It’s the raw material used to produce gasoline, diesel, and other fuels. The price of crude oil can significantly impact global energy costs.

This fossil fuel is used for heating, electricity generation, and as a raw material for chemicals. It’s traded in large quantities, and its price can vary based on supply, demand, and weather conditions.

Used primarily for electricity generation and steel production, coal is a solid fossil fuel. Despite its environmental impact, it remains a key energy source in many parts of the world.

Unlike other commodities, electricity is not stored but generated and consumed in real-time. It is traded in markets where its price can change rapidly based on supply and demand.

These represent the environmental benefits of generating energy from renewable sources like wind or solar. They are traded to help companies meet renewable energy goals and regulations.

Also Read: How To Use Sentiment Analysis To Improve Your Trading

Energy prices are affected by various factors that can cause them to rise or fall. Here’s a look at the main ones:

The basic principle of supply and demand plays a big role. If there is more energy available than people need, prices tend to go down. Conversely, if demand is higher than supply, prices go up. For example, during a cold winter, the demand for heating oil might rise, pushing prices higher.

Political events, like conflicts or trade disputes in energy-producing regions, can disrupt supply and cause prices to spike. For instance, tensions in the Middle East can lead to higher oil prices globally.

Extreme weather can impact energy production and supply. Hurricanes or cold snaps can damage infrastructure and reduce supply, leading to higher prices. For example, a hurricane hitting oil refineries in the Gulf Coast can cause gasoline prices to increase.

The overall health of the economy affects energy prices. In times of economic growth, energy demand usually rises, which can push prices up. During a recession, demand often falls, leading to lower prices.

Advances in technology can impact energy prices by improving efficiency or increasing production. For example, new drilling techniques can unlock more oil reserves, potentially lowering prices.

Government policies, such as environmental regulations or taxes, can also affect prices. For instance, carbon taxes might increase the cost of fossil fuels, which can be passed on to consumers. This is one of the Top Trading Indicators Every Trader Should Know.

The energy trading market involves several key players, each with a distinct role in buying, selling, and managing energy resources. Here’s a look at who they are:

These are companies that produce and supply energy. They include oil and gas companies, electricity generators, and renewable energy providers. For example, ExxonMobil produces oil and gas, while companies like NextEra Energy focus on wind and solar power.

Traders buy and sell energy commodities on behalf of themselves or their clients. Brokers facilitate these transactions, acting as intermediaries to connect buyers and sellers. They use their expertise to navigate the market and find the best deals.

Banks and investment firms invest in energy markets and provide financial products related to energy trading, such as futures contracts and options. They help manage risks and offer capital for energy projects. Firms like Goldman Sachs and JPMorgan Chase are key players in this area.

These organizations regulate and oversee the energy market to ensure fair practices and stability. They set rules for trading, monitor market activities, and enforce regulations. Examples include the U.S. Commodity Futures Trading Commission (CFTC) and the European Securities and Markets Authority (ESMA).

Also Read: How Can Traders Use Fibonacci Retracement Levels?

Technology has brought significant improvements to energy trading, making it faster and more efficient. Here’s how:

These are online systems where traders can buy and sell energy quickly and easily. Platforms like EEX (European Energy Exchange) allow traders to execute trades in real-time, increasing efficiency and transparency.

This involves using computer algorithms to make trading decisions based on market data. Algorithms can analyze large amounts of information quickly and execute trades automatically, often making more precise and faster decisions than human traders.

With the help of big data, traders can analyze massive amounts of information to predict market trends and make better decisions. For example, analyzing weather patterns and historical data can help forecast energy demand and prices.

Blockchain offers a secure way to record and verify transactions. In energy trading, it can be used to create tamper-proof records of trades and ensure transparency in transactions.

AI helps in predicting market trends and optimizing trading strategies. Machine learning algorithms can identify patterns and trends that might not be obvious to human traders, improving decision-making.

These are self-executing contracts with the terms directly written into code. They automatically enforce and execute agreements once certain conditions are met, reducing the need for intermediaries and speeding up transactions.

Also Read: How to Overcome Analysis Paralysis in Trading

The future of energy trading is likely to be shaped by several important trends and changes:

As more countries focus on green energy, trading will increasingly involve renewable sources like wind and solar power. This shift will create new trading markets and opportunities for trading renewable energy credits.

Technology will continue to play a major role. Expect even more use of AI, big data, and blockchain to improve trading efficiency and transparency. These tools will help traders make better decisions and manage risks more effectively.

Energy markets around the world are becoming more connected. This means energy trading will become more global, with greater opportunities to buy and sell energy across borders.

There will be a growing emphasis on sustainability and environmental impact. Traders will need to consider the carbon footprint of their trades and align with stricter environmental regulations.

With the rise of decentralized energy sources like home solar panels and local wind farms, trading might become more local and distributed. This could lead to new ways of trading energy within communities.

Future trading will see improved tools for managing risks related to price volatility and supply disruptions. This will help companies better protect themselves against sudden changes in the market.

Also Read: What Are the Best Time Frames for Swing Trading

In summary, energy trading is a crucial part of the global market, involving the buying and selling of energy commodities like oil, gas, and electricity. Understanding how it works, whether through physical trades, financial contracts, or emerging technologies, is essential for grasping how energy prices are set and how markets operate. Key points include the impact of supply and demand, the role of technological advancements, and the evolving focus on renewable energy and sustainability. These elements highlight why energy trading is not just a technical field but one that influences everyday life and global economies.

For anyone interested in delving deeper into energy trading, exploring further resources or engaging with professionals in the field can provide valuable insights. Staying informed about market trends and technological developments will enhance your understanding and help you make more informed decisions. If you’re eager to learn more, consider checking out educational resources such as ETTFOs or joining Best Trading Course for Your Trading Style in energy trading. The more you know, the better you can navigate this dynamic and important market.

Energy trading involves risks such as price volatility, regulatory changes, and geopolitical events. Effective risk management strategies are crucial for mitigating these risks.

Energy trading influences consumer prices by affecting supply and demand dynamics. High trading activity can lead to price fluctuations, which are often passed on to consumers.

Successful energy traders need skills in market analysis, risk management, and financial instruments. Strong analytical abilities and understanding of market dynamics are also essential.

New traders can start by gaining knowledge through courses, practicing with demo accounts, and staying updated on market trends. Joining trading communities and seeking mentorship can also be beneficial.