Imagine you’re a navigator setting sail on a vast ocean. Your journey’s success depends on your choice of ship, the route you take, and how well you adjust to the ever-changing sea. Similarly, in the world of Forex trading, choosing the right trading strategy is crucial to your success. Just as a sailor needs a reliable map and a solid vessel, a Forex trader needs an effective strategy to navigate the complexities of the market.

With a decade of experience in Forex trading, I’ve seen firsthand how the right strategy can transform trading from a gamble into a disciplined, rewarding endeavor. But with so many strategies out there, from trend following to scalping, how do you know which one will work best for you?

In this article, we’ll embark on a journey through the landscape of Forex trading strategies. We’ll explore various approaches, assess their strengths and weaknesses, and provide insights to help you select the strategy that aligns with your trading goals and style. Whether you’re just starting out or looking to refine your approach, this guide will help you find the best strategy to guide you toward trading success. Let’s dive in and chart a course for better trading.

Also Read: The Benefits of Using Volume Profile in Your Trading Strategy

A Forex trading strategy is a plan or set of rules used by traders to make trading decisions in the foreign exchange market. It involves a methodical approach to buying and selling currencies based on predefined criteria. The strategy might include technical analysis, fundamental analysis, or a combination of both.

Choosing the best Forex strategy is about finding what works best for you. With years of experience, I’ve learned that there’s no one-size-fits-all approach. Here’s a straightforward way to pick a strategy that suits you:

First, think about what you want to achieve. Are you looking for quick profits with frequent trades, or are you more interested in long-term gains with fewer trades? Your goals will guide your choice.

Different strategies fit different trading styles. For instance, if you like to act quickly and make many trades, scalping or day trading might be your thing. If you prefer a more relaxed approach, swing trading or trend following could work better.

How much risk can you handle? If you’re uncomfortable with high risk, choose strategies with lower risk and steady returns. On the other hand, if you’re willing to take more risk for the chance of higher rewards, you might look into more aggressive strategies.

How much time can you dedicate to trading? Some strategies require constant monitoring, while others need only occasional attention. Make sure the strategy fits with your daily routine.

Once you’ve picked a strategy, test it out. Start with a demo account or small trades to see how it performs. Adjust based on your results and comfort level.

Also Read: What is Leverage in Trading and How to Use It Wisely

Having a strategy in Forex trading is essential for several key reasons:

A strategy provides a clear set of rules for when to buy and sell. Without it, trading can become chaotic and driven by emotions, leading to poor decisions and losses.

A well-defined strategy helps you make consistent decisions. This consistency is important for long-term success, as it allows you to stick to a plan and avoid impulsive moves that can hurt your trading performance.

Effective strategies include rules for managing risk, such as setting stop-loss orders to limit potential losses. This helps protect your capital and reduces the chance of significant financial damage.

With a strategy, you base your trades on logic and analysis rather than emotions. This helps you stay disciplined and make decisions that are in line with your trading goals.

A strategy lets you measure and evaluate your performance. You can track how well your strategy is working and make adjustments if necessary to improve your results.

Also Read: Technical Analysis 101: Key Concepts Every Trader Should Know

Let’s look at a simple Forex trading strategy that’s easy to understand and use, even if you’re new to trading.

What It Is: This strategy uses two moving averages—a short-term and a long-term moving average—to spot trading signals.

Choose Your Moving Averages: Start with a short-term moving average (like the 50-day) and a long-term moving average (like the 200-day).

Set Up Your Chart: Apply these moving averages to your Forex chart. The short-term average will react faster to price changes than the long-term average.

Buy Signal: When the short-term moving average crosses above the long-term moving average, it’s a signal that the price might go up. This is often a good time to buy.

Sell Signal: When the short-term moving average crosses below the long-term moving average, it suggests that the price might go down. This is usually a good time to sell.

Example: If you’re trading the EUR/USD pair and the 50-day moving average crosses above the 200-day moving average, you might consider buying EUR/USD. Conversely, if the 50-day moving average crosses below the 200-day, it might be time to sell.

Why It’s Useful: This strategy is straightforward and helps you identify trends. It’s based on clear signals and can be a good starting point for new traders.

Also Read: How Do You Explain the Lot Size in Forex Trading

As we move into 2024, several Forex trading strategies that pro traders use are standing out due to their effectiveness in current market conditions. Here’s a quick overview of the top strategies you should consider:

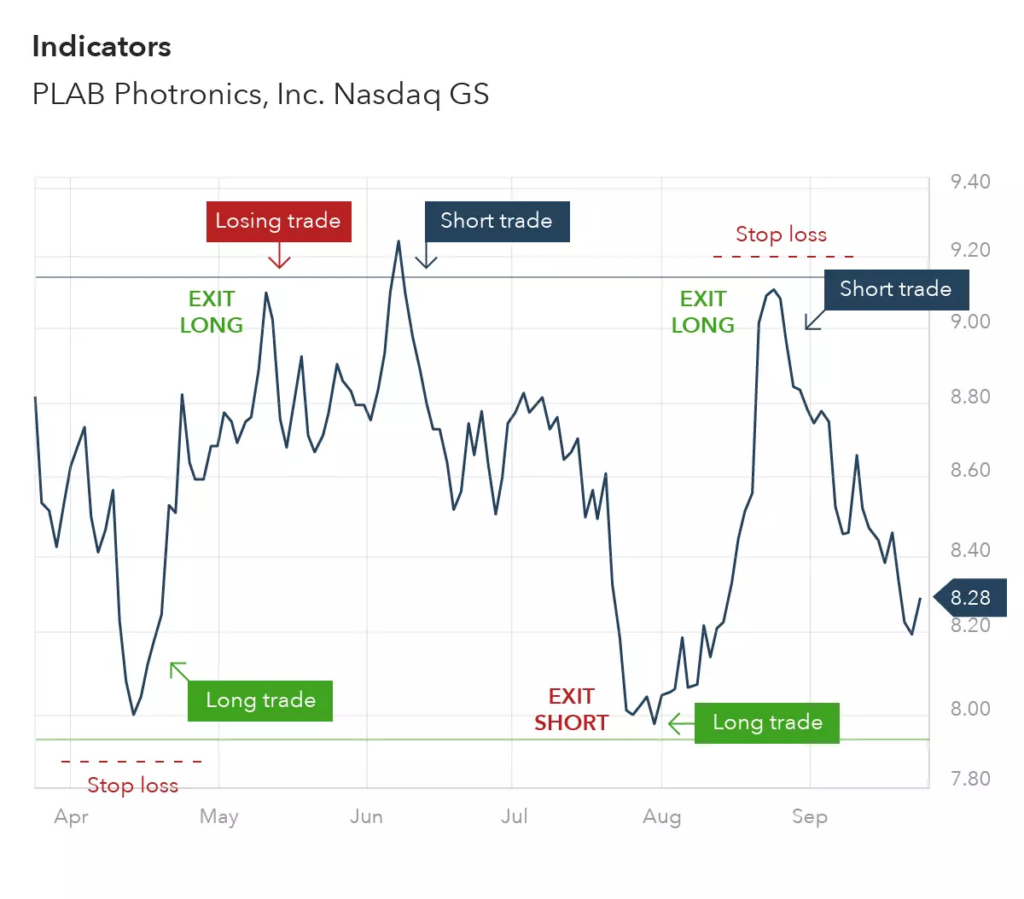

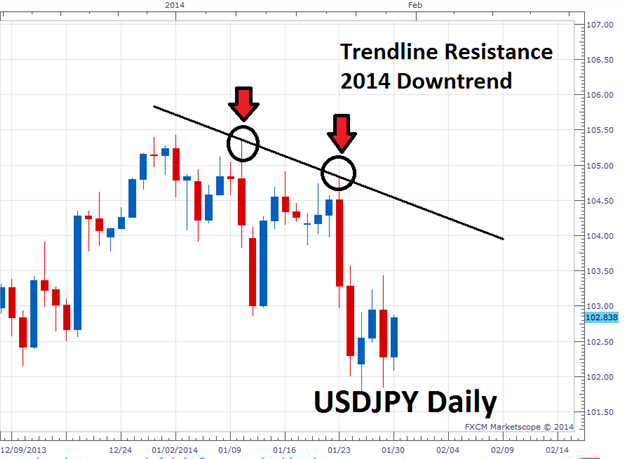

This strategy involves using moving averages for day trading to identify and follow market trends. For example, if the short-term moving average crosses above the long-term moving average, it signals an uptrend, which could be a good time to buy. By drawing lines that connect price highs or lows, traders can identify the direction of the trend and potential reversal points.

This approach focuses on buying at support levels (where the price tends to bounce up) and selling at resistance levels (where the price tends to fall). It’s effective in markets that are moving sideways. Tools like the RSI (Relative Strength Index) can help spot overbought or oversold conditions within a range, guiding entry and exit points.

This strategy looks for price moves that break out of a defined range due to increased volatility. It’s useful for catching strong price movements. Major economic news events can cause sharp price movements. Traders use this strategy to capitalize on these sudden changes.

Short-Term Trades: Scalping involves making quick, small trades to capture tiny price movements. It requires constant monitoring and fast execution.

High-Frequency Trading Techniques: Using algorithms to execute numerous trades at high speeds, this approach aims to profit from very small price changes.

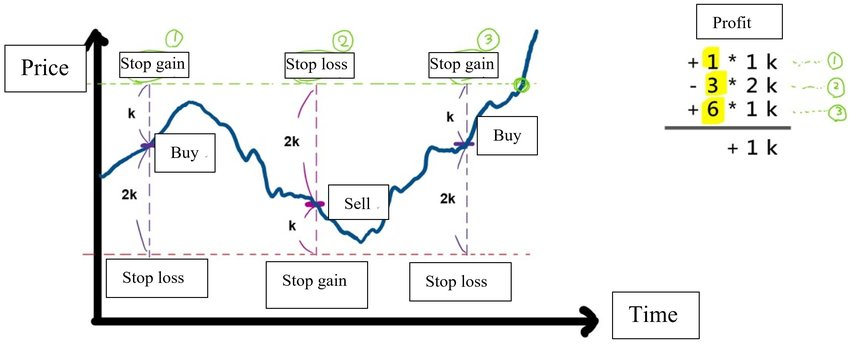

This involves looking for highs and lows in the market to make trades based on short- to medium-term price movements. Indicators like MACD (Moving Average Convergence Divergence) help spot potential reversals and trends.

It is a popular strategy used to identify potential entry points during a trend. Unlike trend-following strategies that focus on catching the initial move, retracement trading aims to take advantage of temporary reversals or pullbacks within the overall trend. For example, imagine the EUR/USD pair is in a strong uptrend. You notice a temporary decline in the price. Using Fibonacci retracement levels, you find that the price is pulling back to the 38.2% level. You decide to buy at this level, expecting the price to continue rising as the trend resumes.

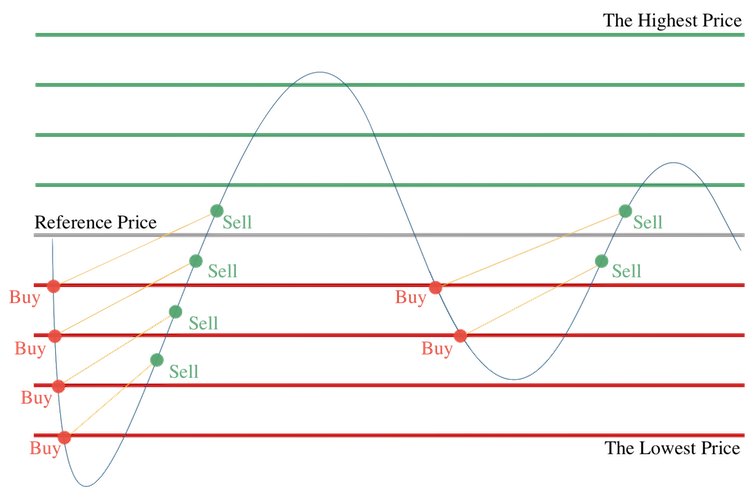

Grid trading is a systematic approach to trading that involves placing buy and sell orders at regular intervals above and below a set price level. It’s designed to profit from market volatility and can be especially useful in ranging or sideways markets. For example, Imagine you’re using grid trading with a 100-pip interval for the EUR/USD pair. If the current price is 1.1000, you might set buy orders at 1.0900, 1.0800, and 1.0700, and sell orders at 1.1100, 1.1200, and 1.1300. As the price fluctuates, some of these orders will be executed, and you’ll aim to profit from the resulting price movements.

Also Read: How Can I Recover My Lost Money from Forex

Advanced Forex trading strategies go beyond the basics and require a deeper understanding of the market. They often involve more complex techniques and tools. Here’s a brief look at some advanced strategies that experienced traders use:

This strategy involves borrowing money in a currency with a low interest rate and investing it in a currency with a higher interest rate. You profit from the difference between the interest rates of the two currencies, known as the “carry.” For example, borrowing in a currency with a 1% interest rate and investing in a currency with a 3% interest rate nets you a 2% profit.

This uses computer algorithms to execute trades based on predefined criteria. It can handle large volumes of trades quickly and accurately. Algorithms follow rules set by the trader, such as entering or exiting trades based on specific market conditions or patterns. This strategy is useful for high-frequency trading.

Arbitrage takes advantage of price differences between markets or instruments. For instance, if the EUR/USD pair is priced differently on two different platforms, you can buy low on one and sell high on the other, capturing the difference as profit.

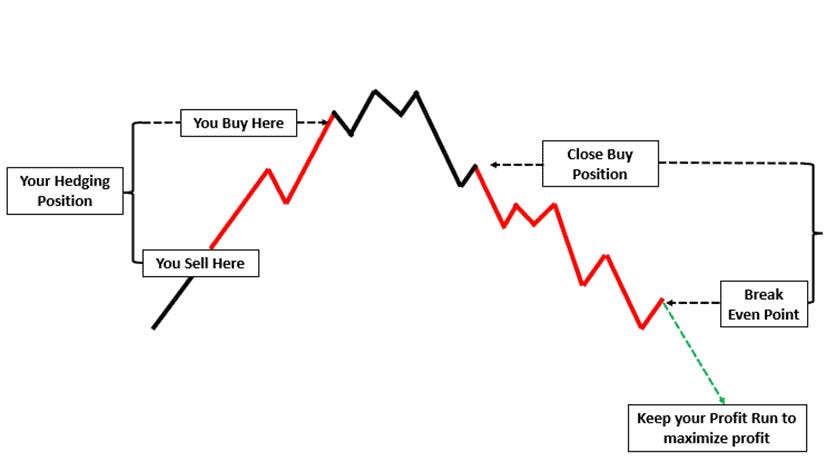

Hedging involves taking offsetting positions to protect against potential losses. If you hold a long position in one currency, you might take a short position in a correlated currency pair. This way, if one position loses, the other can help offset those losses.

This strategy involves analyzing market sentiment to gauge whether traders are feeling bullish or bearish. Tools like the Commitment of Traders (COT) report can show how large traders are positioned, helping you predict market moves based on overall sentiment analysis.

This strategy capitalizes on the impact of economic news and events on the Forex market. Traders watch for news releases, such as interest rate decisions or economic data, and make trades based on how these events might move the market. Timing is crucial, as news can cause sharp price movements.

Also Read: Why You Should Think Twice Before Starting Forex Trading with a Small Amount

When using a Forex trading strategy, adjusting or modifying your approach can improve its effectiveness and help you adapt to changing market conditions. Here are some key modifiers to consider:

Adjusting the time frame you use for analysis and trading. For example, you might use a 15-minute chart for short-term trades or a daily chart for longer-term positions. Switching time frames can give you different perspectives on market trends and help you fine-tune your entry and exit points.

Setting rules to control how much you risk on each trade. This includes stop-loss orders to limit potential losses and position sizing to manage how much of your capital you commit. Effective risk management protects your account from significant losses and helps maintain long-term profitability.

Using additional indicators to complement your primary strategy. For example, if you’re using moving averages, you might add RSI (Relative Strength Index) to help confirm signals. Extra indicators can provide more confirmation and reduce the chance of false signals, improving the accuracy of your trades.

Adapting your strategy based on current market conditions, such as trending or ranging markets. Adjusting your strategy to fit the market environment ensures it remains effective. For example, you might switch from a trend-following strategy to a range-trading strategy during sideways markets.

Incorporating major economic news and events into your trading plan. Economic news can cause significant price movements. By factoring in news events, you can avoid trading during high volatility or capitalize on expected market reactions.

Modifying how often you trade based on your strategy. This could mean increasing or decreasing the number of trades you make. Adjusting trade frequency can help you align with your risk tolerance and market conditions. For example, you might trade more frequently in volatile markets and less in stable ones.

When trading Forex, avoiding common mistakes can make a big difference in your success. With years of experience, here are some key pitfalls to watch out for:

Relying too much on trading robots or algorithms without understanding how they work. Automated systems can fail or behave unpredictably in certain market conditions. Always monitor and understand the systems you use, and don’t rely on them blindly.

Not setting stop-loss orders or risking too much of your capital on a single trade. Poor risk management can lead to significant losses. Use stop-loss orders and diversify your trades to protect your account from large losses.

Overlooking the impact of economic news and events on the market. Major news releases, like interest rate changes or economic reports, can cause sharp price movements. Stay informed about key events and adjust your strategy accordingly.

Trying to recover losses by making more trades or increasing your position size. This can lead to even bigger losses. Stick to your strategy and risk management rules, and avoid making emotional decisions.

Trading without a well-defined plan or strategy. Without a plan, trading can become erratic and driven by emotions. Develop and follow a clear trading plan with specific entry, exit, and risk management rules.

Making too many trades in a short period. Over-trading can lead to higher transaction costs and poor decision-making. Focus on high-quality trades rather than quantity.

Comparing Forex strategies helps you choose the best one for your trading style and goals. Here’s a simple way to do it:

To compare Forex strategies effectively, start by examining their performance metrics. Key metrics include the win rate (the percentage of profitable trades), average profit per trade, and maximum drawdown (the largest loss from a peak to a trough). By reviewing these metrics, you can gauge a strategy’s historical success and risk levels. For example, a strategy with a high win rate and low maximum drawdown might indicate consistent performance and controlled risk. Analyzing these metrics helps you choose a strategy that aligns with your financial goals and risk tolerance.

Each Forex strategy involves different levels of risk, which is crucial to understand before you decide. Evaluate how much capital you might lose on a typical trade and the overall risk management techniques used, such as stop-loss orders and position sizing. For instance, a strategy that uses tight stop-losses and limits position sizes may be more suitable if you prefer lower risk. Conversely, if you can tolerate higher risk for potentially higher rewards, a strategy with wider stop-losses might be acceptable. Matching the risk level of a strategy with your personal risk tolerance helps protect your investment from large losses.

Different Forex strategies involve varying trade frequencies. Some strategies, like scalping, require frequent trades and constant market monitoring, while others, such as swing trading, involve fewer trades over longer periods. Assess how often each strategy triggers trades and whether this matches the time you can dedicate to trading. If you have limited time and cannot constantly monitor the market, a strategy with fewer trades and longer holding periods might be more practical. Choosing a strategy that fits your available time helps you maintain consistency and avoid over-trading.

Forex markets can be trending, ranging, or volatile, and different strategies perform better in different conditions. For example, trend-following strategies work well in strong trending markets but may underperform in sideways or choppy conditions. Conversely, range trading strategies are designed for markets that move within a set range. By evaluating how each strategy handles various market conditions, you can select one that remains effective regardless of whether the market is trending or ranging. This adaptability ensures that your strategy remains robust and effective in different market environments.

The complexity of a Forex strategy can vary greatly. Some strategies use a single indicator and are straightforward to implement, while others may involve multiple indicators, algorithms, or advanced techniques. Consider how complex each strategy is and whether you can easily understand and manage it. A simpler strategy might be easier to implement and adapt to, especially if you’re new to Forex trading. On the other hand, more complex strategies might offer greater precision and customization if you have the expertise and resources to handle them. Choosing a strategy that matches your understanding and comfort level helps you trade more effectively.

Before committing real money, it’s essential to test each strategy using a demo account. Demo accounts simulate live market conditions without financial risk, allowing you to see how a strategy performs in real-time. By practicing with a demo account, you can evaluate how well the strategy fits your trading style and whether it meets your expectations. This testing phase helps you refine your approach and make adjustments before applying the strategy in a live trading environment. It’s a practical way to ensure the strategy works well and suits your needs without risking your capital.

Having the right resources and tools is crucial for successful Forex trading. Here’s a rundown of essential resources and tools that can help you navigate the Forex market effectively:

Trading platforms are the software applications where you execute trades and analyze the market. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer features like real-time price charts, technical indicators, and trading tools. They also support automated trading through Expert Advisors (EAs), which can help you set up and execute trades based on predefined criteria.

An economic calendar is a tool that provides a schedule of upcoming economic events and reports, such as interest rate decisions, employment data, and GDP releases. Keeping track of these events is crucial because they can significantly impact currency prices. Websites like Forex Factory and Investing.com offer detailed economic calendars to help you stay informed about market-moving events.

Technical analysis tools help you analyze historical price data and identify trends or patterns. Common tools include charting software and indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands. These tools assist you in making informed trading decisions based on past price movements. Most trading platforms come with built-in technical analysis tools, but there are also standalone options like TradingView for more advanced charting.

Trading signals provide buy or sell recommendations based on market analysis. These signals can be generated by technical indicators, algorithms, or expert analysis. Services like MQL5 Signals offer access to a range of trading signals that you can use to guide your trading decisions. However, it’s essential to use signals as a supplementary tool and not rely on them entirely.

Risk management tools are vital for protecting your trading capital. These include features like stop-loss orders, which automatically close a trade at a set loss level, and position sizing calculators to determine the appropriate amount of capital to risk on each trade. Many trading platforms include these tools, and they help you manage risk effectively and maintain discipline.

Staying updated with the latest news is essential for understanding market movements and making informed decisions. Forex news websites like Bloomberg, Reuters, and DailyFX provide real-time news and analysis that can impact currency markets.

Choosing the best Forex trading strategy is crucial for achieving success in the Forex market, and it largely depends on your individual trading style and goals. From trend following and range trading to scalping and breakout strategies, each approach has its strengths and weaknesses. Understanding these strategies and aligning them with your risk tolerance and market conditions is essential for making informed trading decisions.

One noteworthy resource that stands out in the realm of Forex trading is ETTFOS.COM. Their ETTFOS Core Masterclass offers a comprehensive and structured approach to mastering Forex trading. This program is designed to provide traders with advanced strategies, practical insights, and hands-on training that can significantly enhance their trading skills. By leveraging the expertise and tools available through ETTFOS, traders can gain a competitive edge and develop a more effective trading strategy tailored to their needs.

Ultimately, the best Forex trading strategy is one that aligns with your trading style and helps you navigate the complexities of the market. Whether you’re exploring various strategies or considering specialized training like the ETTFOS Core Masterclass, continuous learning and adaptation are key to achieving sustained success in Forex trading.

The most popular Forex trading strategies include trend following, range trading, and breakout trading. Each has its own set of rules and applications based on market conditions.

To start with Forex trading strategies, begin by choosing a strategy that fits your trading style and goals. Then, backtest and forward test the strategy to ensure it works under different market conditions.

Yes, many traders use multiple strategies to diversify their trading approach and adapt to different market conditions. For example, you might combine trend following with range trading for a balanced approach.

Keep up the amazing work!