Imagine you’re ready to dive into the exciting world of forex trading. Traditionally, this journey starts with a broker—a middleman who helps you buy and sell currencies. But what if you want to skip the middleman and trade directly in the forex market? It sounds intriguing, doesn’t it? Trading without a broker means you could potentially lower costs and gain direct access to market prices. However, this route also requires you to handle all the trading responsibilities on your own.

In this article, I’ll show you how you can start forex Trading without broker and what tools and fundamental analysis of forex trading you’ll need. Understanding these options is important because technology has made it easier to trade independently. With new platforms, you can manage your trades yourself, often saving money and gaining more control. If you’re interested in cutting out the middleman and taking full charge of your trading, this guide will help you explore if this approach is right for you.

Also Read: Is It Possible to profit consistently in forex trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their value. You trade currencies in pairs, like EUR/USD, and aim to predict whether the value of one currency will rise or fall relative to another. The forex market is open 24 hours a day, five days a week, providing constant opportunities for trading. Prices in the forex market are determined by supply and demand, economic events, and market sentiment. Traders use leverage to control larger positions with a smaller amount of money, amplifying both potential gains and losses. Transactions are executed through online platforms provided by brokers, which display bid and ask prices—the rates at which you can buy or sell currencies.

In forex trading, a broker acts as an intermediary between you and the market. They provide access to the trading platform where you can buy and sell currencies. Brokers offer various tools and resources to help you make informed decisions, like charts, news updates, and analysis. They also handle the execution of your trades, ensuring that your buy or sell orders are processed quickly. Additionally, brokers may offer leverage, which lets you control larger trades with a smaller amount of money, though this also increases risk. Overall, brokers facilitate your entry into the forex market, making it easier to trade and manage your investments.

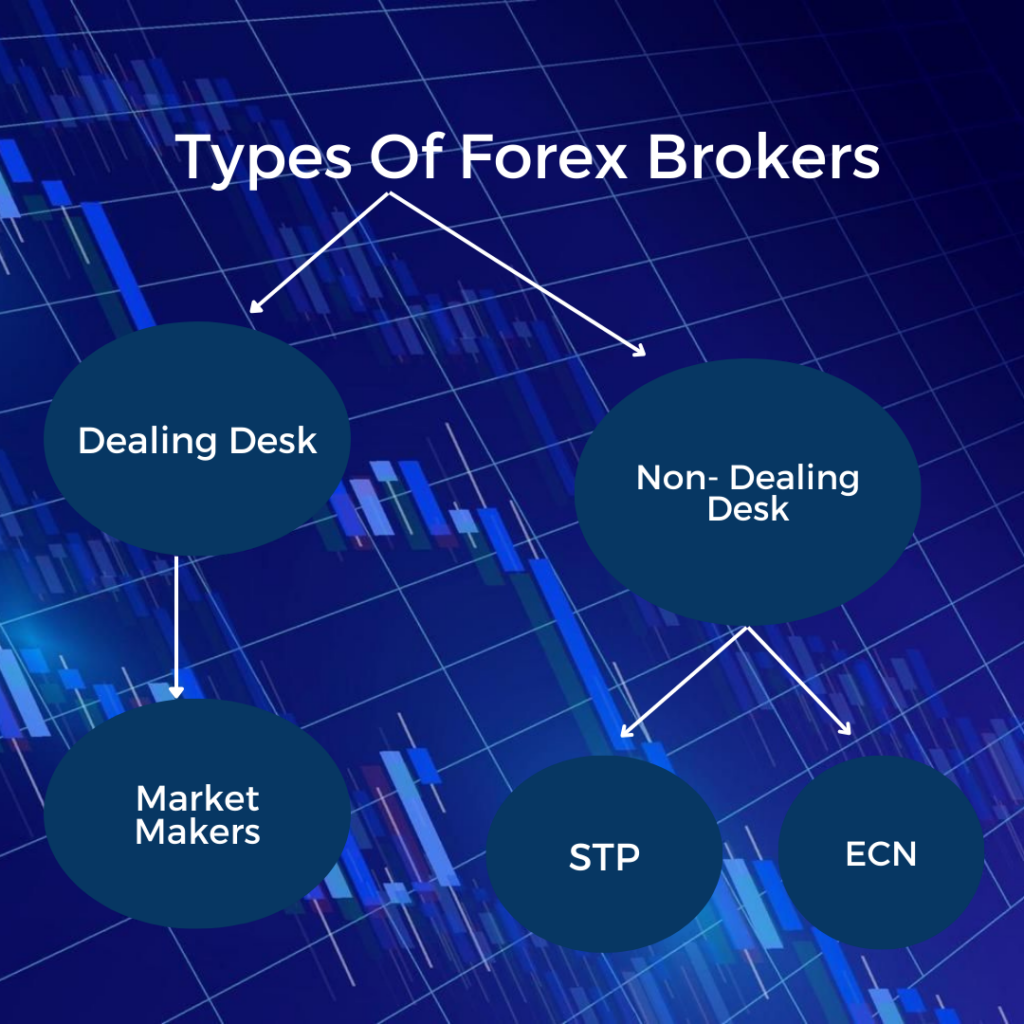

There are several types of forex brokers, each offering different ways to trade. Here’s a quick overview:

These brokers set their own bid and ask prices and often act as the counterparty to your trades. They profit from the spread, which is the difference between the buying and selling prices. Market makers provide liquidity and can be a good choice for beginners due to their fixed spreads and ease of access.

ECN brokers connect traders directly to the interbank market, where they can trade with other market participants. They offer tighter spreads and faster execution but usually charge a commission per trade. ECN brokers are preferred by more experienced traders who value direct market access.

These type of brokers send your orders straight to the liquidity providers or the interbank market without dealing with them themselves. This usually results in faster execution and variable spreads. They often charge a small commission or a markup on the spreads.

DMA brokers offer direct access to the forex market with no middlemen. They provide transparent pricing and are favored by high-frequency traders who need speed and accuracy.

Forex brokers facilitate trading by connecting clients to the currency market. Here’s a simplified explanation of how they operate:

Brokers form agreements with liquidity providers like major banks or ECN systems to access market liquidity. They also open separate bank accounts to keep client funds safe and separate from their own.

To start trading, a client signs a service agreement with the broker and sets up a personal trading account. The client then deposits funds into this account.

When a client wants to buy or sell currencies, they place an order through a trading platform. These orders can be executed in several ways:

To trade forex effectively, you need a broker because they provide critical access and tools that you can’t get on your own. Here’s why :

Brokers offer trading platforms where you can view real-time quotes, analyze market trends, and place trades. Without a broker, you wouldn’t have access to these platforms or the tools needed for effective trading.

Brokers have the necessary licenses and technology to connect to the global forex market. They set up the infrastructure to ensure your trades are executed quickly and accurately through platforms like MetaTrader and ECN systems.

Forex brokers provide leverage, allowing you to trade with a smaller amount of money than you would need to buy or sell large volumes directly. Without a broker, you’d need a substantial amount of capital to achieve similar returns, making trading impractical for most individuals.

Also Read: How to Draw Support and Resistance Lines for Forex Trading

Trading with a broker has its drawbacks too. Here are some of them:

Brokers often charge fees and commissions for their services, which can reduce your overall profits. These costs might include spreads, trading commissions, or account maintenance fees.

Some brokers might have conflicts of interest, such as benefiting from the spread between buy and sell prices or handling trades in-house, which can affect the quality of your trade execution.

Brokers might impose restrictions on trading strategies or leverage, which can limit your ability to execute certain trades or manage risk according to your preferences.

Brokers ensure that your orders are processed almost instantly. Without them, you’d face delays and potentially miss out on favorable prices, turning potential profits into losses.

Yes, a broker can trade for himself, and this is a common practice in the industry. Brokers often trade in the forex market using their own accounts to take advantage of market opportunities. This is separate from their role of executing trades for clients.

However, to avoid conflicts of interest and ensure fairness, many brokers have strict regulations and policies in place. They must ensure that their own trading activities do not negatively impact their clients’ trades. Regulatory bodies also oversee these practices to maintain market integrity and protect investors. In summary, while brokers can trade for themselves, they must do so under strict guidelines to ensure that their personal trading does not interfere with or harm the trades of their clients.

Forex trading without broker is generally not practical for most people. Brokers provide the necessary access to the forex market through their trading platforms and systems. They connect you to liquidity providers and offer tools for executing trades.

Forex trading without broker, you would need direct access to the forex market, which is usually reserved for large institutions or very high-net-worth individuals. Banks and other financial institutions might offer currency exchange services, but they don’t provide the trading platforms or leverage needed for active forex trading.

Trading forex without a traditional broker can be challenging but there are a few alternative methods:

Some platforms allow direct trading with the forex market, bypassing traditional brokers. These are often used by institutional traders and require significant capital and technical expertise.

P2P forex trading platforms connect traders directly with each other, allowing them to trade currencies without a middleman. These platforms handle the trade matching and execution.

Large banks and financial institutions sometimes offer forex trading services directly to clients with substantial funds. However, this usually involves higher minimum requirements and is not typically accessible for retail traders.

Some automated trading systems, like algorithmic trading platforms, can execute trades based on pre-set rules without the need for a traditional broker. These systems still need to be connected to the market through a broker or another trading infrastructure.

Also Read: Explore, Is Forex Trading Profitable?

Platforms that allow direct forex trading typically cater to institutional traders or advanced retail traders. Here are a few notable ones:

This platform provides direct access to the forex market with real-time pricing and deep liquidity. It’s widely used by large financial institutions.

Integral offers a trading platform that connects directly to major liquidity providers, allowing for direct market access and high-frequency trading.

FXall is another platform designed for institutional traders, offering direct access to global forex markets and a range of trading tools.

Previously known as Thomson Reuters, this platform provides direct access to forex trading with extensive market data and analytics.

Trading forex without a broker can be appealing for those seeking more control and lower costs. By bypassing brokers, you can potentially access better pricing and avoid paying various fees. However, this approach comes with its own set of challenges and limitations.

| Pros | Cons |

| No Broker Fees | Higher Risk |

| Direct Market Access | Lack of Professional Advice |

| Full Control Over Trades | Increased Complexity |

| Potentially Better Pricing | Limited Tools and Resources |

| No Conflicts of Interest | Requires Extensive Knowledge |

| Ability to Implement Custom Strategies | Difficulties in Accessing Liquidity |

Starting forex trading without broker involves several steps:

To do forex trading without broker, start by selecting a direct access trading platform. These platforms, like ECN or institutional systems, connect you straight to the forex market. They allow you to place trades directly, bypassing traditional brokers, and often offer better pricing and faster execution. Make sure the platform you choose supports the currency pairs you want to trade and fits your trading needs.

When trading without a broker, ensure you have enough capital to meet the platform’s minimum deposit requirements. Direct access platforms often need a higher initial investment compared to traditional brokers. Having sufficient funds is crucial for opening positions and managing trades effectively in the forex market. Stay updated on the specific capital requirements of your chosen trading platform. Regularly review your financial situation and trading needs to ensure that you can meet these requirements while maintaining a balanced and manageable investment approach. This is one of the advanced trading strategies pro traders use.

To trade independently, set up the necessary technology. This includes acquiring a reliable trading platform with real-time data, charting tools, and analysis software. Ensure your internet connection is stable to execute trades smoothly and receive timely market updates. Proper technology is essential for efficient trading and accurate decision-making.

Before starting, thoroughly evaluate your financial situation to ensure you can meet the platform’s capital requirements without jeopardizing your financial stability. Consider your overall financial health and whether you can comfortably allocate the necessary funds for trading.

If possible, begin with a smaller amount of capital to familiarize yourself with the platform and trading process. This approach allows you to test the waters and develop your trading strategy without committing a large sum upfront. As you gain experience and confidence, you can gradually increase your investment. This is the best strategy to avoid losses in forex trading.

To trade on your own, gain a solid understanding of forex market mechanics. Study trading strategies, market trends, and techniques of mastering risk management in forex trading. Knowing how the market works and being able to analyze and interpret data will help you make informed decisions and manage your trades effectively without a broker’s guidance.

Once you start trading, handle all aspects of your trades on your own. This includes placing orders, monitoring market conditions, and adjusting your strategies as needed. Without a broker, you are responsible for managing your positions, tracking performance, and making timely decisions to achieve your trading goals.

Also Read: How To Use Sentiment Analysis To Improve Your Trading

Trading Forex solo comes with several risks and considerations. Here are some of these:

Firstly, in forex trading without broker, you miss out on professional support and guidance. Brokers often provide valuable resources like market analysis and trading tools, which you’ll need to find on your own.

Secondly, managing all aspects of trading can be overwhelming. You’ll be responsible for making all trading decisions, monitoring the market, and handling any issues that arise. This requires a strong understanding of forex trading and constant attention to market changes.

Lastly, in doing forex trading without broker the capital requirements can be high. Direct trading platforms often require significant upfront investment, which might be a barrier for many individual traders. It’s important to be prepared for these financial demands and to ensure you have the skills and knowledge needed to trade effectively on your own. Direct access platforms often require a significant upfront investment, which can be a barrier if you don’t have sufficient capital. Inadequate funds may also limit your ability to open and manage trades effectively, potentially leading to missed opportunities or forced liquidation of positions.

The high initial capital required can place a considerable financial burden on traders. This can strain your finances and create risk if the investments do not perform as expected. It’s important to ensure that committing this capital will not negatively impact your overall financial health or lead to undue stress.

With higher capital requirements, you may have less flexibility in managing your trades. Large minimum trade sizes or high margin requirements can restrict your ability to diversify your portfolio or adapt quickly to market conditions. This can limit your trading strategies and increase your exposure to market risks.

When doing forex trading without broker, regulatory concerns are significant. Unlike brokers who are typically regulated and must adhere to financial rules, direct trading platforms might not have the same oversight. This lack of regulation can increase the risk of dealing with unreliable or potentially fraudulent platforms. This is one of the top trading indicator every trader should know.

Without a broker, you need to be extra cautious about the platform you choose. Make sure the platform is regulated by reputable financial authorities to ensure it meets legal and safety standards. Additionally, be aware of the legal implications and protections available when trading directly, as you might have fewer recourses if issues arise.

In summary, forex trading offers various opportunities, but it comes with complexities. We’ve covered the basics of forex trading, common mistakes trader make, the crucial role of brokers in facilitating trades, and the potential of trading without a broker. Brokers provide essential services, such as access to trading platforms, market analysis, and risk management tools. However, some traders opt to go solo, using direct access platforms to trade independently.

Deciding whether to trade with or without a broker depends on your experience level and trading goals. If you’re new to forex trading or prefer having professional support, using a broker can be beneficial. On the other hand, if you have sufficient knowledge, capital, and are comfortable managing trades yourself, direct trading might be an option to consider.

To deepen your understanding of forex trading, explore courses and resources available at ETTFOS.COM. Signing up for updates can also keep you informed about the latest in forex trading and help you make well-informed decisions.

Yes, it is possible to start Forex trading without a traditional broker by using Direct Market Access (DMA), trading platforms that allow direct trading, or alternative methods like Peer-to-Peer (P2P) trading and automated trading systems.

Direct Market Access (DMA) allows traders to directly access the Forex market and execute trades without the need for a traditional broker. This method provides real-time access and can offer faster execution of trades.

Trading Forex without a broker can come with several risks including lack of support, potential security issues, and higher personal responsibility for trade management. It’s crucial to choose reputable platforms and ensure robust security measures are in place.

Peer-to-Peer (P2P) Forex trading connects traders directly with one another to exchange currencies. Platforms facilitating P2P trading allow users to negotiate and trade directly, often leading to reduced costs compared to traditional brokers.